emerging market stocks definition

At the same time iron-clad commitments to abstain from recontracting are. An emerging market is the economy that has characteristics of a developed market but doesnt yet contain all characteristics needed to be developed.

Emerging market funds can be mutual funds or ETFs and help diversify ones financial portfolio.

. Emerging markets on the other hand are in the process of rapid growth and development but they have lower household incomes and capital. Stock exchanges often through American depositary receipts ADRs. Keys to spotting a good emerging growth stock.

Start browsing stocks funds and ETFs. Earnings per share EPS. Stock Index FO Trading Calls Market Analysis.

Owing to impressive growth statistics and strong-performing stock markets investor assets have been flooding into emerging markets during the past year. This includes markets that may become developed markets in the future or were in the past. Some common characteristics of emerging markets are illustrated below.

Most developed markets are located in North America Western Europe and Australasia. Characteristics of Emerging Markets. As developing economies become richer they seek to contract with the global economy in increasingly complex ways.

Commodity Trading Calls Market Analysis. Ad Gain Daily Exposure To Global Emerging Markets. Leaders of developing countries want to create a better quality of life for their people.

Ad Learn About the Advantages Everyday Investors Have Over Big Banks and Institutions. When a collective decides to invest the majority of its assets in securities commodities stocks and bones in the economy of developing countries they create an emerging market fund. This helps explain why Greeces stock market actually rallied when the country was demoted from developed to emerging status by MSCI in November 2013.

High growth increases competition and can yield. One way to invest in emerging markets is to buy stocks in countries with rapidly developing economies. As of 2006 the economies of China.

The term frontier market is used for developing countries with smaller riskier or more illiquid capital markets than emerging. They include countries like the United States Canada Germany the United Kingdom Australia New Zealand and Japan. Some international stocks trade on US.

Definition and Examples of Emerging Markets. Emerging market stocks. The MSCI Emerging Markets Index is an index created by Morgan Stanley Capital International MSCI designed to measure equity market performance in global emerging.

However such recontracting is viewed with concern particularly by market participants. Emerging markets are countries that are transitioning from the developing phase to the developed phase. Although this kind of stock offers unusually large returns it is very risky because the expected growth may not occur or the firm may be swamped by the competition.

They are moving away from their traditional economies that have relied on agriculture and the export of raw materials. Free 2-hour Trading Workshop and Lab our investing QuickStart Kit Stock Picks more. An emerging market is a market that has some characteristics of a developed market but does not fully meet its standards.

Dealing with that complexity often implies the need to renegotiate contracts. Learn More About EDC EDZ. That is emerging markets are economies that have increasingly important roles in the international stage and may one day become principal players but they.

An ADR represents one or more shares of a foreign stock and is bought and sold like a domestic stock. Market volatility stems from political instability external price movements andor supply-demand shocks due. An emerging market is by definition a country that hasnt reached developed market status yet but appears on track to become one in the not-too-distant future.

Emerging markets are nations that are investing in more productive capacity. A Google search for the definition of emerging markets draws this rich haul2 The market of a developing country with high growth expectations. Thanks for a timely question.

An economy in a country noted for growing liquidity stability infrastructure and other positive features though not to the same extent as exists in the developed world. MSCI Emerging Markets Index. The common stock of a relatively young firm that is operating in an industry that has very good growth prospects.

Find examples of developing markets. A sector within international stocks made up of developing countries such as Kenya and China where economic and political conditions may be more volatile. The financial markets of developing economies.

Technical Call Trading Calls Insights.

Rule Of 72 Calculator Rule Of 72 Student Finance Rules

Emerging Markets Definition Characteristics Seeking Alpha

The Small Cap Opportunity In Emerging Markets Institutional Investor

My Barbell Strategy Emergency Fund Investing Personal Finance

Ray Dalio S Portfolio Investing Strategy Finance Investing Personal Development Skills

Forex Broker Binary Option Click Link Investment Tips Invest Wisely Finance Investing

7 Common Money Conflicts In Marriage And How To Solve Them Family Sciences Research Paper 2 2019 Investing Personal Finance Dividend Stocks

/GettyImages-183829224-577d0e6b04744cd09ca24cf396fa95f0.jpg)

Emerging Market Fund Definition

Forex Broker Binary Option Click Link Investment Tips Invest Wisely Finance Investing

Stock Market Graph Or Forex Trading Chart For Business And Financial Concepts Stock Market Data Bullish Point Stock Market Graph Trading Charts Stock Market

Programming Code Abstract Technology Background Of Software Developer Emerging Technology Computer Science Computer Science Degree

Rotation Strategies Within Emerging Markets Stocks Marketing Asset Management Stock Market

The Small Cap Opportunity In Emerging Markets Institutional Investor

Premium Photo Stock Market Or Forex Trading Graph In Graphic Concept Stock Market Global Stock Market Forex Trading

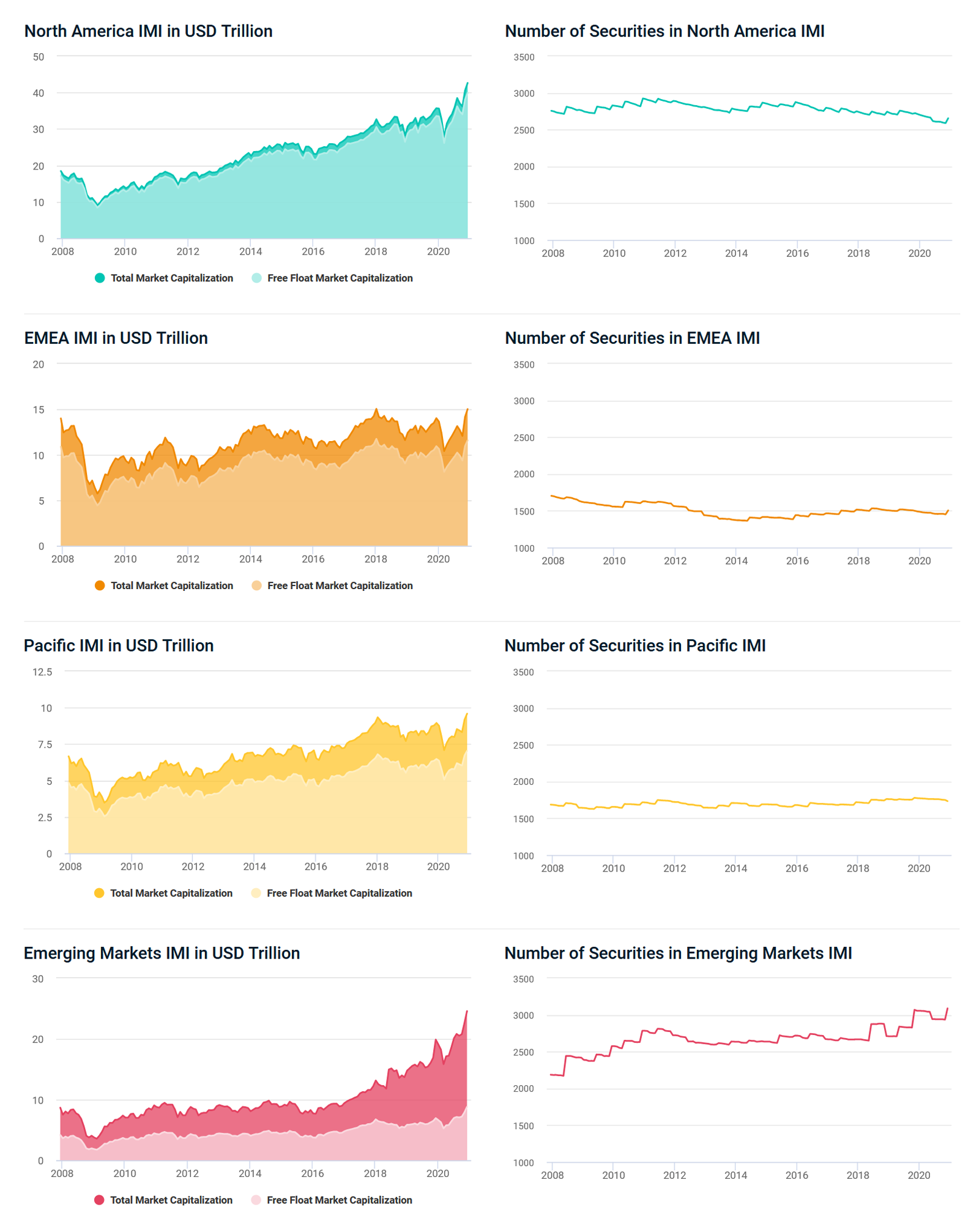

Global Investing Trends Not All Listed Stocks Are Investable The Concept Of Free Float Market Capitalization Msci

:max_bytes(150000):strip_icc()/eem-974a5bc170894a75aebf825f703893d5.png)

:max_bytes(150000):strip_icc()/GettyImages-1060422076-dda95d194e2b436ca976e64fe6723de3.jpg)